Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_53semiannual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/53/semiannual/04/index.html on line 80

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_53semiannual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/53/semiannual/04/index.html on line 80

Report of Operating Results and Financial Position for the Six Months ended April 30, 2017

[Management Environment]

During the first two quarters of Kanamoto’s current consolidated fiscal year, Japan’s economy maintained a gradual recovery trend, and the effects of various government policies as well as improvements in corporate operating performance and in the employment and income environment were evident. On the negative side of the balance, on the other hand, uncertainty remained strong and concerns that demanded a prudent stance, including apprehension over the economic slowdown in China and newly developing countries, the situation in Europe pertaining to Great Britain’s exit from the EU, and policy management in the United States, were unabated.

[Second Quarter Consolidated Operating Results]

In the construction industry related to the Kanamoto Group, demand remained brisk. In addition to the brightening outlook noted in private sector capital investment, including redevelopment projects in metropolitan areas, spending on public works projects was buoyed by maintenance and renewal demand in the disaster prevention and disaster mitigation sector, and by expenditures to address Japan’s rapidly ageing social infrastructure.

Given such circumstances, the Kanamoto Group resolutely pursued the various measures in its Long-term Corporate Management Plan BULL55 (FYE October 2015 – FYE October 2019), the action plan aimed at achieving the Group’s continuous growth. To ensure strong earnings, Kanamoto continued to pursue efficiency improvements by repositioning existing assets and implementing thorough and comprehensive cost reductions, while also working to create its new system for efficiently utilizing rental assets, which will further ensure the certainty of these measures.

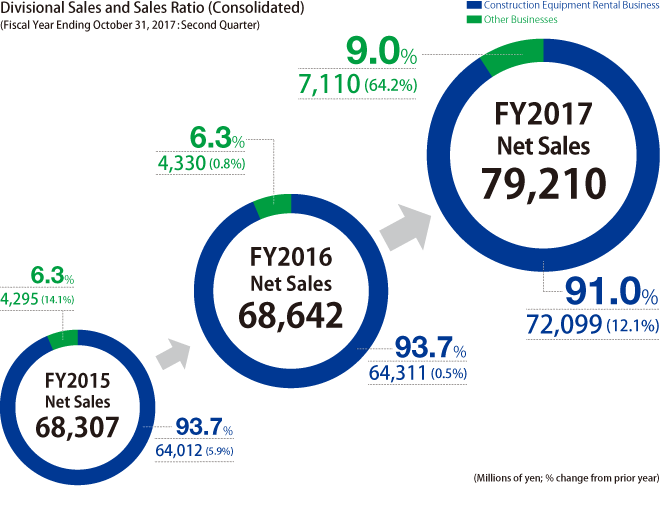

As a result, net sales for the consolidated interim period ended April 30, 2017 rose by 15.4% from the same period of the previous consolidated fiscal year to ¥79,210 million. With regard to earnings, operating income increased 16.1% from the same period of the previous consolidated fiscal year to ¥9,993 million, ordinary income increased 24.2% year-on-year to ¥10,242 million, and interim period profit attributable to owners of parent rose 30.2% year-on-year to ¥6,468 million.

[Segment Information]

Business related to the Construction Equipment Rental Division

In the construction-related business that is Kanamoto’s primary business focus, construction equipment rental demand remained brisk, driven by strong demand centered on Hokkaido and Kyushu, works related to the Tokyo Olympics, and the gradual start of construction on large-scale redevelopment works in the Tokyo metropolitan area. The Company moved forward with the creation of its continuous support system in particular, including the centralization of management resources and establishment of new branches, to strengthen its support for recovery efforts following the Kumamoto earthquake, Kagoshima typhoon disaster, and Hokkaido typhoon disaster, all of which occurred last year. In the Kyushu Region, both net sales and operating income for the consolidated interim period expanded substantially as a result of having added the performance of Nishiken Co., Ltd. to consolidated operating results from the third quarter of the prior consolidated fiscal year.

Used construction equipment sales fell 2.5% year-on-year, as Kanamoto sold equipment based on its initial plan aimed at maintaining an appropriate asset portfolio.

As a result of the above factors, interim period net sales for Kanamoto’s construction-related businesses increased 12.1% from the same period of the prior consolidated fiscal year to ¥72,099 million, and operating income improved 12.2% year-on-year to ¥9,259 million.

Other Businesses

In Kanamoto’s other businesses, both steel products-related sales and sales in the information and telecommunications-related division were roughly in line with the same period one year earlier, but because of the addition of the Company’s welfare-related business, net sales rose 64.2% from the same period of the prior consolidated fiscal year to ¥7,110 million, and operating income jumped 247.3% year-on-year to ¥534 million.

[Change in number of branches]

The Company opened one new branch, the Hidaka Equipment Center (Saru-gun, Hokkaido), and closed one branch, the Tsugaru Dam Branch (Nakatsugaru-gun, Aomori Prefecture), during the second quarter consolidated accounting period.

Consolidated Operating Results

| (Millions of yen; % change from prior year) | Fiscal Year Ended October 31, 2016: Second Quarter |

Fiscal Year Ending October 31, 2017: Second Quarter |

|---|---|---|

| Net Sales | 68,642 (0.5) | 79,210(15.4) |

| Operating Income | 8,605(△19.2) | 9,993(16.1) |

| Ordinary Income | 8,246(△22.6) | 10,242(24.2) |

| Profit attributable to owners of parent | 4,967(△23.9) | 6,468(30.2) |

| Basic earnings per share | ¥140.57 | ¥183.03 |

Divisional Sales (Consolidated)

| (Millions of yen; % change from prior year) | Fiscal Year Ended October 31, 2016: Second Quarter |

Fiscal Year Ending October 31, 2017: Second Quarter |

|---|---|---|

| Construction Equipment Rental Business | 64,311(0.5) | 72,099(12.1) |

| Other Businesses | 4,330(0.8) | 7,110(64.2) |

| Total | 68,642(0.5) | 79,210(15.4) |

Projected Consolidated Operating Results for the Fiscal Year Ending October 2017

| (Millions of yen; % change from prior year) | Consolidated full-year projection |

|---|---|

| Net Sales | 155,800 (7.5) |

| Operating income | 17,130(13.2) |

| Ordinary income | 17,360(20.5) |

| Profit attributable to owners of parent | 10,730(32.5) |

| Basic earnings per share | ¥303.63 |