Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_51annual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/51/annualreport/03/index.html on line 102

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_51annual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/51/annualreport/03/index.html on line 102

Consolidated Financial Highlights

| Millions of yen |

Thousands of U.S. dollars (Note) |

||

|---|---|---|---|

| 2014 | 2015 | 2015 | |

Consolidated operating results |

|||

| Net sales | ¥125,555 | ¥133,292 | $ 1,102,498 |

| Operating income | 16,454 | 16,270 | 134,580 |

| Ordinary income | 16,078 | 16,164 | 133,699 |

| Net income | 9,299 | 9,557 | 79,053 |

| ROE | 15.8% | 14.4% | 14.4% |

| Dividend payout ratio | 13.6% | 13.1% | 13.1% |

| Plant and equipment investment | 30,625 | 27,639 | 228,617 |

Consolidated financial position |

|||

| Total assets | 188,491 | 202,919 | 1,678,410 |

| Net assets | 65,513 | 71,998 | 595,519 |

| Equity ratio | 33.6% | 34.3% | 34.3% |

Consolidated cash flows |

|||

| Net cash provided by (used in) operating activities | 24,782 | 33,509 | 277,168 |

| Net cash provided by (used in) investing activities | –3,374 | –4,488 | (37,122) |

| Net cash provided by (used in) financing activities | –22,405 | –24,857 | (205,604) |

| Cash and cash equivalents at end of period | 31,980 | 36,150 | 299,008 |

Information per share of common stock |

yen | U.S. dollars (Note) | |

|---|---|---|---|

| Net income | ¥258.02 | ¥266.27 | $2.20 |

| Net assets | 1,758.24 | 1,969.16 | 16.28 |

| Dividends per share | 35.00 | 35.00 | 0.28 |

Note: U.S. dollar amounts have been translated from yen for convenience only, at the rate ¥120.90=US $1, the approximate exchange rate on October 30, 2015.

Finance and Investment Strategies

A unique financial strategy corresponding to the characteristics of a stock business

Because equipment rental is a stock-based business, Kanamoto’s

debt/equity ratio is higher than in other industries. As a financial strategy to service this debt, Kanamoto is working to increase shareholders’ equity, and reducing interest-bearing debt and streamlining its balance sheet to limit capital asset investment to within the scope of annual cash flow.

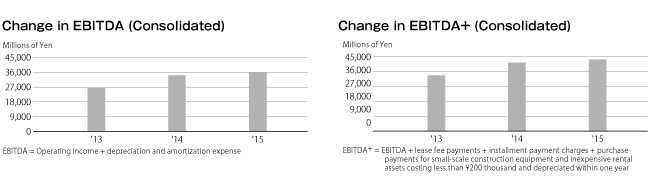

A future-oriented investment strategy to secure the source of Kanamoto’s earnings

Kanamoto makes vigorous capital investments annually, which result in an amortization burden corresponding to this volume of assets. Equipment rental, however, is a business characterized by the ability to receive a gain from the sale of used equipment after rental earnings have been ensured. In other words, the depreciation expenses incurred during each fiscal year become the source of future earnings. For this reason, Kanamoto considers its most important management indicators to be EBITDA+ (operating income + depreciation and amortization expense + lease fee payments + installment payment charges + purchase payments for small-scale construction equipment and inexpensive rental assets) and ROI (return on investment), rather than current year operating results, and has always worked to achieve growth in these indicators.