Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_52semiannual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/52/semiannual/03/index.html on line 106

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_52semiannual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/52/semiannual/03/index.html on line 106

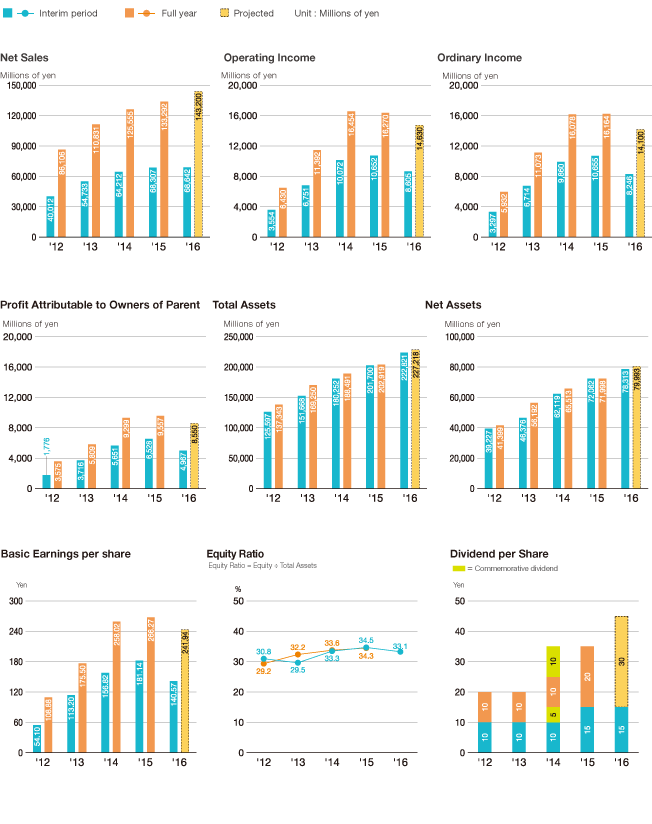

Consolidated Financial Highlights

| Millions of yen | Thousands of U.S. dollars (Note) |

||

|---|---|---|---|

| April 30, 2015 | April 30, 2016 | April 30, 2016 | |

Consolidated operating results |

|||

| Net sales | ¥ 68,307 | ¥ 68,642 | $ 625,444 |

| Operating income | 10,652 | 8,605 | 78,405 |

| Ordinary income | 10,655 | 8,246 | 75,140 |

| Profit attributable to owners of parent | 6,528 | 4,967 | 45,262 |

| Comprehensive income | 7,283 | 5,178 | 47,188 |

Consolidated financial position |

|||

| Total assets | 201,700 | 222,821 | 2,030,265 |

| Net assets | 72,062 | 78,313 | 713,562 |

| Equity ratio | 34.5% | 33.1% | 33.1% |

Consolidated cash flows |

|||

| Net cash provided by (used in) operating activities | 17,596 | 16,666 | 151,856 |

| Net cash provided by (used in) investing activities | -1,842 | -7,173 | -65,364 |

| Net cash provided by (used in) financing activities | -12,051 | -9,200 | -83,835 |

| Cash and cash equivalents at end of period | 35,692 | 36,469 | 332,294 |

Information per share |

Yen | U.S. dollars (Note) | |

|---|---|---|---|

| April 30, 2015 | April 30, 2016 | April 30, 2016 | |

| Basic earnings per share | ¥ 181.14 | ¥ 140.57 | $ 1.28 |

| Dividends per share | 15.00 | 15.00 | 0.13 |

Financial Topics

Net Sales

As a result of pushing ahead with key initiatives based on the various measures in its Medium-term Management Plan (fiscal 2014 - fiscal 2016), taking steps to improve and expand its domestic base of operations, including enhancing its branches in the Tokyo metropolitan area and other locations where public and private sector demand is concentrated, and converting Nishiken Co., Ltd., the largest construction equipment rental firm in the Kyushu Region, into a subsidiary, Kanamoto was able to marginally exceed net sales in the same period of the prior fiscal year.

Earnings

Operating income, ordinary income, and profit attributable to owners of the parent were all lower than in the same period one year earlier, reflecting factors such as investments in rental equipment the Company continues to undertake in order to pursue its regional strategy aimed at enhancing and expanding its base of operations, and the concomitant increase in the burden for depreciation and amortization.