Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_52annual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/52/annualreport/13/index.html on line 91

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_52annual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/52/annualreport/13/index.html on line 91

Financial Section

Report of Operating Results and Financial Position for the 52nd Business Period (November 1, 2015 – October 31, 2016)

Matters Concerning the Corporate Group

Summary of consolidated fiscal year operating results

In the fiscal year under review, Japan’s economy maintained a modest recovery trend, supported by the continuation of the government’s economic and monetary policy measures. However, we must remain wary about conditions, given the economic slowdown in emerging countries, as well as the softness in the stock market and yen appreciation spurred by fears of a global economic slowdown due to the UK’s vote to leave the EU.

In the construction industry related to the Kanamoto Group, private sector construction investment was solid both for building and capital investment. Moreover, demand related to disaster recovery and the Tokyo Olympics and Paralympics was strong, but the management environment was challenging due to overall weakness in construction demand, as indicated by the decline in public sector investment in outlying areas.

Given such circumstances, the Kanamoto Group moved forward with key initiatives which were based on various measures in its Medium-term Management Plan (fiscal 2014 to fiscal 2016). In addition to expanding its base in the Tokyo metropolitan area and other locations in which public and private sector demand is concentrated, the Company took steps to augment and expand its domestic base of operations, including making NISHIKEN CO., LTD. (Kurume City, Fukuoka Prefecture), the largest construction equipment rental firm in the Kyushu region, a subsidiary in March 2016.

Consequently, in the fiscal year ended October 31, 2016 net sales rose 8.7% from the prior consolidated fiscal year level to ¥144,870 million. On the earnings front, operating income decreased 7.0% year on year to ¥15,134 million and ordinary income fell 10.9% to ¥14,405 million, reflecting the increased burden for depreciation and amortization resulting from increases in assets such as rental assets. Profit attributable to owners of parent decreased 15.3% over the prior consolidated fiscal year to ¥8,098 million.

Consolidated Operating Results

| (Millions of yen; % change from prior year) | Fiscal Year Ended October 31, 2015 | Fiscal Year Ending October 31, 2016 |

| Net Sales | 133,292 (6.2) | 144,870 (8.7) |

| Operating Income | 16,270 (-1.1) | 15,134 (-7.0) |

| Ordinary Income | 16,164 (0.5) | 14,405 (-10.9) |

| Profit attributable to owners of parent | 9,557 (2.8) | 8,098 (-15.3) |

| Net Income per Share | ¥ 266.27 | ¥ 229.16 |

Summary of consolidated operating results by business segment

Business related to the Construction Equipment Rental Division

In the construction-related business that is Kanamoto’s core business, construction demand was brisk primarily for recovery and restoration in the Tohoku Region and infrastructure refurbishment ahead of the Tokyo Olympics and Paralympic Games. In other regions, however, the operating environment grew more severe as demand for construction equipment rentals was uneven in some regions during the fiscal year under review as public works projects were put off.

In these conditions, the Group focused all of its resources on supporting reconstruction efforts by strengthening affiliations with Group companies and efficiently allocating management resources between companies to participate in disaster recovery efforts following the earthquake in the Kumamoto region and reconstruction after torrential rain storms in Hokkaido.

By region, sales in this business fluctuated as follows: down 0.5% in the Hokkaido Region, up 2.6% in the Tohoku Region, up 6.1% in the Kanto & Koushinetsu Region, down 1.1% in the Kansai & Chubu Region, and up 89.9% in the Kyushu & Okinawa Region. The inclusion of NISHIKEN CO., LTD. in the scope of consolidation led to a significant increase in net sales in the Kyushu Region, where there had been little previous expansion of bases.

Sales of used construction equipment slipped 4.1% versus the previous fiscal year, reflecting the systematic sale of equipment that had been in service for a certain number of years to maintain a proper composition of assets.

Reflecting these factors, the Kanamoto Group posted net sales in the construction-related businesses of ¥131,208 million, an increase of 6.2% year-on-year, and operating income of ¥14,057 million, a decrease of 9.8%.

< Current Conditions of the Company’s Group >

Kanamoto, Daiichi Kikaisangyo Co., Ltd., Kanki Corporation, and NISHIKEN CO., LTD. are engaged in the rental and sale of construction equipment. Assist Co., Ltd. and its affiliate Asahi Rentax Co., Ltd. deal in the rental and sale of furniture, fixtures and safety products. Kanatech Co., Ltd. engages in the design and sale of modular housing units for temporary use. Kyushu Kensan Co., Ltd. deals in rental and sale of construction equipment centered on foundation equipment. Toyo Industry Co., Ltd. Handles the rental and sale of equipment related to shield tunneling. Unite Co., Ltd. handles the rental and sale of road construction equipment and carries out road construction. KG Flowtechno Co., Ltd. Engages in the rental, design, manufacturing, and sale of specialty equipment that is used mainly for ground improvement and the construction of underground structures. Eiwashoukai Co., Ltd. engages in the rental of general-purpose, small-scale construction equipment.

Outside Japan, construction equipment rentals and sales are carried out by Shanghai Jinheyuan Engineering Construction Co., Ltd. and Shanghai KG Machinery Co., Ltd., a subsidiary of KG Flowtechno Co., Ltd., in Shanghai, China, by KANAMOTO (HK) CO., LTD. in Hong Kong, China, by Kanamoto & JP Nelson Equipment (S) PTE. Ltd. in Singapore, by PT Kanamoto Indonesia in Indonesia, by SIAM KANAMOTO LTD. in Thailand, by KANAMOTO FECON HASSYU CONSTRUCTION EQUIPMENT RENTAL JSC in Vietnam and by KNK MACHINERY & EQUIPMENT CORPORATION in the Philippines.

These group companies also lease rental equipment from Kanamoto when necessary. In the same fashion, Kanamoto leases rental equipment from these group companies, which it in turn leases to other companies. Kanamoto purchases modular housing units for temporary use from Kanatech Co., Ltd.

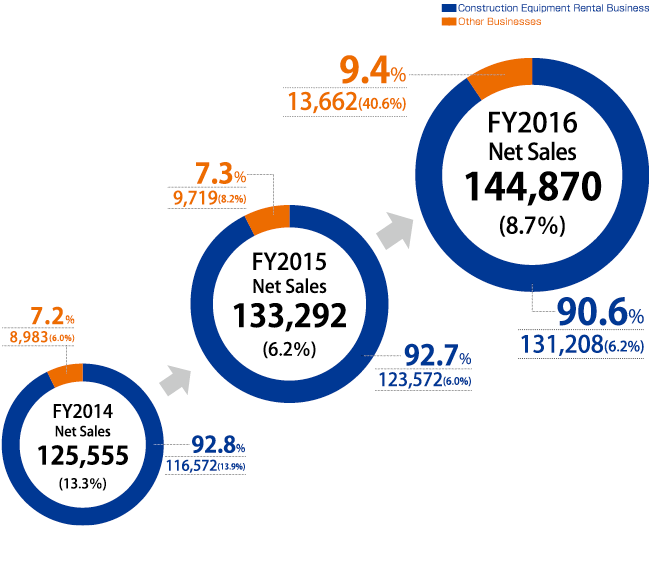

Divisional Sales (Consolidated)

| (Millions of yen; % change from prior year) | Fiscal Year Ended October 31, 2015 | Fiscal Year Ending October 31, 2016 |

| Construction Equipment Rental Business | 123,572 (6.0) | 131,2080 (6.2) |

| Other Businesses | 009,719 (8.2) | 013,662 (40.6) |

| Total | 133,292 (6.2) | 144,8700 (8.7) |

Other Businesses

In the Company’s other businesses, sales were steady at those related to both the Steel Sales Division and the Information Products Division. Coupled with the addition of NISHIKEN’s businesses such as its welfare-related business, this resulted in a 40.6% increase in net sales from the same period of the prior consolidated fiscal year to ¥13,662 million and a 118.8% increase in operating income to ¥660 million.

< Current Conditions of the Company’s Group >

This segment mainly consists of the business related to the Steel Sales Division, the business related to the Information Products Division, the welfare-related business and Other businesses.

In the business related to the Steel Sales Division, Kanamoto sells construction materials, including steel products. In addition, in the business related to the Information Products Division and Other businesses, the Company handles the rental and sales of computers and peripherals, including workstations and servers. In the welfare-related business, NISHIKEN CO., LTD. rents and sells nursing care products.

■ Divisional Sales and Sales Ratio (Consolidated)

(Millions of yen; % change from prior year)

Change in number of branches

The Company opened eight new branches and closed one branch.

New branches: Kumagaya Branch (Kumagaya City, Saitama Prefecture), Fukushima Machinery Maintenance Center (Koriyama City, Fukushima Prefecture), Okegawa-Kitamoto Branch (Kitamoto City, Saitama Prefecture), Chusan Branch (Zentsuji City, Kagawa Prefecture), Shinjo Branch (Shinjo City, Yamagata Prefecture), Yamanashi-Minami Branch (Minamikoma-gun, Yamanashi Prefecture), Ishikari Branch (Ishikari City, Hokkaido), Kashiwazaki Branch (Kashiwazaki City, Niigata Prefecture)

Closed branch: Yubari Machinery Maintenance Center (Yubari City, Hokkaido)

Medium- to Long-term Management Strategy

The Company’s medium- to long-term management strategy is included in BULL 55, the long-term vision, and BULL 53, the medium-term corporate management plan. In accordance with this plan, Kanamoto plans to aggressively expand its operations base in the Kanto & Koshinetsu region, the home to major projects such as the Linear Chuo Shinkansen and infrastructure development and redevelopment projects related to the Tokyo 2020 Summer Olympic/Paralympic Games, and also aims to build a structure that will enable the Company to bolster earnings in the Tokyo metropolitan area, in line with medium- to long-term demand forecasts. In addition, as a long-term growth engine, Kanamoto aims to strategically move forward with development of an overseas base for operations, mainly in the ASEAN nations, where strong underlying demand is a potential long-term growth engine. The Company will also proactively participate in innovation fields, such as METI’s i-Construction project to raise productivity on construction sites.

Meanwhile, to enhance risk resilience to adapt to changes in the business environment, Kanamoto aims to build a management system that will facilitate sustainable growth in the long term by further improving its earnings management and strengthening its corporate governance system.

Outlook for the Next Fiscal Year (Fiscal year ending October 2017)

In the next fiscal year, we expect demand for construction equipment rentals to be solid due to the shinkansen extension project and reconstruction and recovery work following torrential rains in Hokkaido, earthquake disaster reconstruction work in the Tohoku region, infrastructure-related construction ahead of the Tokyo Olympics and Paralympics, other private-sector redevelopment projects in the Tokyo metropolitan area and reconstruction and recovery work following earthquakes in Kumamoto and other regions. However, in light of delays in starting construction projects as a result of labor shortages and skyrocketing material and equipment costs, we believe the overall management environment does not warrant optimism and will remain harsh.

Looking forward, while continuing to support the disaster restoration and revitalization projects in the specific regions, we aim to enhance and grow our domestic sales base with a focus on interregional cooperation by promoting further expansion of branches, particularly in areas where we are yet to open branches, including the Tokyo metropolitan area and the greater Kanto region, in accordance with key measures of the medium-term management plan BULL 53.

Regarding overseas business expansion, the Group will continue actively expanding and strengthening its existing branches in cooperation with local partner companies in China (Shanghai and Hong Kong), Singapore, Indonesia, Vietnam, Thailand, and the Philippines.

In addition, to continue building corporate value, the Company plans to concentrate management resources in fields in which it can leverage the Group’s comprehensive capabilities. The Company aims to build a structure to facilitate the fortification of its financial position and earnings strength.

In light of the aforementioned measures, the Kanamoto Group aims for net sales of ¥153,000 million, a growth of 5.6% year-on-year, operating income of ¥15,820 million, an increase of 4.5%, ordinary income of ¥15,580 million, a rise of 8.2%, and profit attributable to owners of parent of ¥9,460 million, an improvement of 16.8%.

Projected Operating Results for the Fiscal Year Ending October 31, 2017

| (Millions of yen; % change from prior year) | Consolidated full-year projection | Non-consolidated full-year projection |

| Net Sales | 153,0000 (5.6) | 104,300 (0.5) |

| Operating Income | 15,8200 (4.5) | ー |

| Ordinary Income | 15,5800 (8.2) | 12,130 (-0.0) |

| Consolidated:Profit attributable to owners of parent/Non-consolidated:Net income | 9,460 (16.8) | 7,740 (13.2) |

| Net Income per Share | ¥ 267.69 | ¥ 219.02 |