Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_50annual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/50/annualreport/14/index.html on line 96

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_50annual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/50/annualreport/14/index.html on line 96

Financial Section

Report of Operating Results and Financial Position for the 50th Business Period (November 1, 2013-October 31, 2014)

Matters Concerning the Corporate Group

Summary of consolidated fiscal year operating results

In the consolidated fiscal year under review, the economy in Japan, underpinned by government economic and financial policies, posted modest recovery trends, including an improvement in corporate earnings and an increase in capital investments. However, the economic outlook remains unclear due in part to the impact the consumption tax hike has had on private consumption and concerns of a downturn in economies overseas.

In the construction-related business that is the Kanamoto Group's main business, public works demand continued to increase owing to budgets allocated for reconstruction work in quake-damaged regions, building national resilience, and for disaster prevention. In addition, construction equipment rental demand also continued to rise owing to positive trends in private-sector construction investments. Meanwhile, there were still concerns going forward, in part due to the postponed startup of construction and extended construction periods reflecting still high material and equipment prices, and a lack of skilled labor.

Amidst such conditions, the Kanamoto Group drew up a long-term vision dubbed BULL 55. As an action plan, the company released BULL 53, a medium-term corporate management plan that covers the fiscal year ending October 31, 2015 to the fiscal year ending October 31, 2017. The goal of this medium-term corporate management plan is to maximize Group strengths to build a management infrastructure that is stable and with sustainable earnings in the future. To this end, Kanamoto aims to further improve its corporate value by (1) expanding the reach of Kanamoto's domestic base of operations, (2) improving the Group's overall operational structure by building a new system that will serve as the Group's infrastructure, and (3) expanding its businesses overseas.

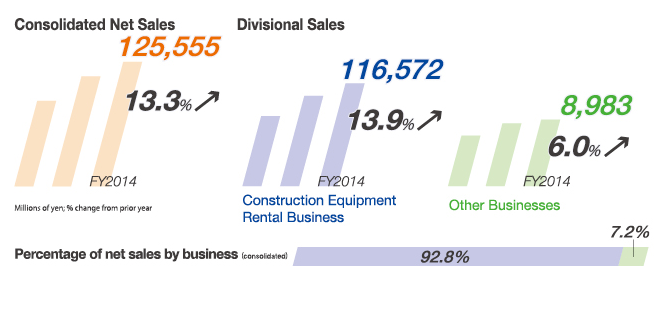

Consequently, in the fiscal year ended October 31, 2014, net sales rose 13.3% from the prior consolidated fiscal year level to ¥125,555 million. Meanwhile on the profit front, operating income expanded 44.4% from the prior consolidated fiscal year to ¥16,454 million and consolidated ordinary income increased 45.2% year-on-year to ¥16,078 million. Net income rose 60.1% over the prior consolidated fiscal year to ¥9,299 million.

Summary of consolidated operating results by busin-ess segment

Business related to the Construction Equipment Rental Division

In the construction-related business that is the main business of Kanamoto, demand from public works projects trended at a high level owing to the full-fledged startup of reconstruction projects in quake-damaged regions and the government's execution of a 15-month budget for seamless fiscal stimulus. Moreover, nationwide construction equipment rental demand remained steady owing to stable construction to fix deteriorating infrastructures in regions throughout Japan and to prevent or alleviate natural disasters, and also owing to the private-sector civil engineering work, including railway, communications, gas, and harbor/port projects.

The Kanamoto Group is aggressively invested in facilities to maximize its response to the aforementioned demand. Consequently, sales rose year-on-year thanks to accurate asset allocation and fortification of operations. That said, sales sharply increased in all regions. Sales performance by region for this segment is as follows: sales rose 11.4% in the Hokkaido Region; 19.5% in the Tohoku Region; 6.3% in the Kanto & Shinetsu Region; 15.2% in the Kansai & Chubu Region; and 9.0% in the Kyushu & Okinawa Region compared with the prior consolidated fiscal year.

Sales of used construction equipment rose 63.6% versus the previous fiscal year, reflecting the systematic sale of equipment that had been in service for a certain number of years to ensure a reasonable asset composition.

As a result of these factors, net sales for Kanamoto's construction-related businesses for the consolidated fiscal year under review increased 13.9% from the prior consolidated fiscal year to ¥116,572 million, and operating income climbed 45.7% year-on-year to ¥15,910 million.

< Subsidiaries >

Kanamoto, Daiichi Kikaisangyo Co., Ltd., Kanki Corporation, Kyushu Kensan Co., Ltd., Toyo Industry Co., Ltd., Unite Co., Ltd., and KG Flowtechno Co., Ltd. are engaged in construction equipment rental and sales.

Kyushu Kensan Co., Ltd. deals in rental and sales of construction equipment centered on foundation equipment. Toyo Industry Co., Ltd. handles the rental and sales of equipment related to shield tunneling. Unite Co., Ltd. conducts roadway construction equipment rental and sales and roadway construction. KG Flowtechno Co., Ltd. and its subsidiary Shanghai KG Machinery Co., Ltd. carry out equipment rental and technical development, and also the manufacture and sales of construction equipment for ground improvement.

Assist Co., Ltd. and its affiliated Asahi Rentax Co., Ltd. deal in the rental and sales of furniture, fixtures and safety products. Kanatech Co., Ltd. engages in the design and sale of modular housing units for temporary use.

These companies, depending on need, also lease rental equipment from Kanamoto. In the same fashion, Kanamoto leases rental equipment from these companies, which it in turns leases out to other companies. Kanamoto purchases modular housing units for temporary use from Kanatech Co., Ltd.

In China, Shanghai Jinheyuan Engineering Construction Co., Ltd. carries out construction equipment rental and sales, and also imports construction materials and equipment. Meanwhile, KANAMOTO (HK) CO., LTD. in Hong Kong and Kanamoto & JP Nelson Equipment (S) PTE. Ltd. in Singapore both handle construction equipment rentals and sales.

Fiscal Year ended October 31, 2014 Consolidated Operating Results

| (Millions of yen; % change from prior year) | Net Sales | Operating Income | Ordinary Income | Net Income | Net Income per Share of Common Stock | ||||

| Consolidated Fiscal Year Under Review | 125,555 | (13.3) | 16,454 | (44.4) | 16,078 | (45.2) | 9,299 | (60.1) | ¥258.02 |

| Prior Consolidated Fiscal Year | 110,831 | (28.7) | 11,392 | (77.2) | 11,073 | (86.6) | 5,809 | (62.5) | ¥175.50 |

Percentage of net sales by business (consolidated)

Other Businesses

In Other Businesses, net sales increased 6.0% from the prior consolidated fiscal year to ¥8,983 million, while operating income also increased 5.9% year-on-year to ¥216 million, reflecting steady sales at businesses related to the Steel Sales Division and the Information Products Division.

< Subsidiaries >

Kanamoto Engineering Co., Ltd. manages specified worker dispatching undertakings to dispatch engineering-related research and development employees to manufacturers and other entities.

Change in number of branches

During the consolidated fiscal year under review, Kanamoto newly opened 2 branches and closed 2 branches.

New branches: Rikuzentakata Branch (Rikuzentakata, Iwate Prefecture), Osaka-Kita Branch (Takatsuki, Osaka Prefecture)

Closed branches: Sendai-Nishi Branch (Aoba, Sendai, Miyagi Prefecture), Mikasa Machinery Center (Mikasa, Hokkaido Prefecture)

Medium-to Long-term Corporate Management Strategy

The Company's medium-term corporate management strategy is included in BULL 53, the Medium-term Management Plan. In accordance with this plan, Kanamoto plans to aggressively expand its operations base in the Kanto & Shinetsu region, the home to major projects such as infrastructure development and redevelopment projects related to the Tokyo 2020 Olympic and Paralympic Games, and build a structure that will enable the Company to bolster earnings in the Tokyo metropolitan area, in line with medium- to long-term demand forecasts. In addition, as a long-term growth engine, Kanamoto aims to strategically move forward with the development of an overseas base for operations, mainly in the ASEAN nations, where demand potential is high.

Outlook for the Next Fiscal Year (Fiscal year ending October 2015)

Turning to the outlook for the next fiscal year, construction demand is expected to remain strong mainly in the Tohoku region and Tokyo metropolitan area, owing to the full-fledged startup of reconstruction in quake-damaged areas, the development of the Linear Shinkansen, the redevelopment of areas around new stations on the Yamanote line, and the start of construction related to the Tokyo 2020 Games. However, looking at construction demand in other regions, fiscal expenditures are trending downward, creating a murkier outlook for public works and other demand. Furthermore, the business climate is expected to be grimmer than a year earlier due to unsuccessful bidding and delays in construction starts reflecting still-high materials and equipment prices and as the lack of skilled labor becomes the norm.

Going forward, the Kanamoto Group aims to continue to assist in the quick restoration of disaster-stricken areas. Concurrently, as the first step of the new Medium-term Management Plan, the Company plans to accelerate branch openings in the metropolitan areas of Kanto and Kansai, and other under-served areas, and ultimately build a base for operations to achieve the goals in the third and final year of its Medium-term Management Plan. In addition, to continue to expand corporate value, the Company plans to concentrate management resources in fields in which it can leverage the Group's comprehensive capabilities. The Company aims to build a structure to facilitate the fortification of its financial position and earnings strength.

That said, with regard to overseas business expansion, the Company aims to aggressively move forward by developing partnerships with strong local companies, mainly in Asia where there is future growth potential.

Main targets in the Medium-term Management Plan BULL 53

| Net Sales (hundred millions of yen) | Operating Income (hundred millions of yen) | Equity Ratio | EPS (Yen) | BPS (Yen) | ROA | ROE | EBITDA+ (hundred millions of yen) | |

| Fiscal year ending October 31, 2017 | 1,500 | 190 | 45%-plus | 260 | 2,400 | 5.5%-plus | 10%-plus | 500 |

Fiscal year ending October 2015 Projected Operating Results (November 1, 2014 - October 31, 2015)

| (Millions of yen; % change from prior year) | Net Sales | Operating Income | Ordinary Income | Net Income | Net Income per Share of Common Stock |

| Consolidated full-year projection | 128,600 (2.4) | 16,960 (3.1) | 16,610 (3.3) | 9,520 (2.4) | ¥264.15 |

| Non-consolidated full-year projection | 096,300 (2.1) | - | 14,190 (4.7) | 8,500 (3.9) | ¥235.85 |