Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_49semiannual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/49/semiannual/03/index.html on line 83

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_49semiannual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/49/semiannual/03/index.html on line 83

Report of Operating Results and Financial Position for the Six Months ended April 30, 2013

Changes in accounting principles, procedures and presentation methods pertaining to preparation of the consolidated financial statements.

a) Beginning from this consolidated accounting fiscal year, the Company has adopted the "Accounting Standard for Quarterly Financial Reporting" and the "Guidance on Accounting Standard for Quarterly Financial Reporting." In addition, the quarterly consolidated financial report has been prepared in accordance with the "Regulation for Quarterly Consolidated Financial Statements."

b) Changes in appraisal standards and appraisal methods for principal assets Inventory assets

Beginning from the first quarter of the consolidated accounting fiscal year ended October 31, 2009, the Company will apply the "Accounting Standard for Measurement of Inventories" and will value inventories based on the original cost method, with cost being determined mainly by the Last-in, First-out method (amounts shown on Balance Sheets are calculated by determining write-downs of book value based on decline in profitability).

The affect of this change on earnings is not material.

Construction equipment

Traditionally, the Company and its domestic consolidated subsidiaries valued construction equipment using the amount after deduction of depreciation expense as calculated according to the declining-balance method from the original prices, by separate fiscal year of purchase. Beginning from the first quarter of the consolidated accounting fiscal year ended October 31, 2009, the Company will calculate the amount after deduction of depreciation expense as calculated according to the straight-line method from the original prices, by separate fiscal year of purchase.

As a result, the cost of revenues from operations decreased by ¥34 million, and gross profit, operating income, ordinary income and income before taxes and adjustments increased by the same amount, respectively, compared to what they otherwise would have been had the accounting standards used in past periods been applied.

Changes in accounting standards used for normal accounting treatment

Application of accounting standards for lease transactions (Lessee side)

The Company traditionally accounted for finance lease transactions other than leases that transfer ownership of the property by applying accounting treatment based on the method applied for ordinary rental transactions. For quarterly consolidated financial statements pertaining to the consolidated fiscal year that begins on or after April 1, 2008, however, corporations will be able to apply the "Accounting Standard for Lease Transactions" and the "Guidance on Accounting Standard for Lease Transactions", and beginning from the first quarter of the consolidated accounting fiscal year ended October 31, 2009, the Company will apply these standards and account for such transactions using a method similar to that used for ordinary sale and purchase transactions. In addition, for depreciation for lease assets related to finance lease transactions other than leases that transfer ownership of the property, the Company has adopted the straight-line depreciation method, using the term of the lease as the depreciable life and a residual value of zero.

For finance lease transactions other than leases that transfer ownership of the property for which the lease transaction starting date predates the beginning of the first year in which the lease accounting standard will be applied, the Company will continue to apply the accounting practices based on the method for ordinary rental transactions.

The affect of this change on earnings is not material.

Change in depreciation methods for principal depreciable assets (Tangible fixed assets)

Traditionally, the Company and its domestic consolidated subsidiaries have applied the declining balance method for depreciation of rental equipment. Beginning from the first quarter of the consolidated accounting fiscal year ended October 31, 2009, the Company and its domestic subsidiaries have adopted the straight-line depreciation method.

As a result, the cost of revenues from operations decreased by ¥1,129 million, and gross profit, operating income, ordinary income and income before taxes and adjustments increased by the same amount, respectively, compared to what they otherwise would have been had the accounting standards used in past periods been applied.

Management Environment

During the Kanamoto Group's interim period, a mild recovery trend was evident in Japan's economy, driven by weakening of the yen that originated in a sense of anticipation toward fiscal and economic policy. At the same time, however, worries about the risk of an economic downturn proved impossible to shake and the future economic outlook remained uncertain, as businesses and consumers continued to fret about Europe's interminable debt problems, the delayed recovery of the overseas economy including China and the United States, the surge in the yen exchange rate and the jump in crude oil prices.

Interim Period Consolidated Operating Result

In the construction industry surrounding the Kanamoto Group, the so-called "15-month budget" is moving forward and government construction investment is on an upward trend, primarily for public works focused on earthquake restoration and recovery works, mainly in the earthquake-devastated regions, and for nationwide disaster prevention and disaster mitigation works. Brighter signs were evident for private sector investment as well. Nevertheless, there were lingering sources of concern, including a shortage of skilled construction workers and a sharp rise in labor costs, glitches in the construction tender system and delays in the start of construction.

Given such circumstances, the Kanamoto Group sought to enhance its integrated corporate vitality, and proceeded to strengthen its collaboration with Group firms and transactions with alliance firms and forge an organization capable of demonstrating synergistic effects for the entire Group. The Group worked to thoroughly analyze and improve its present operating processes and increase its efficiency as well, and undertook efforts to build an organization aimed at boosting earnings through a comprehensive focus on cost reductions.

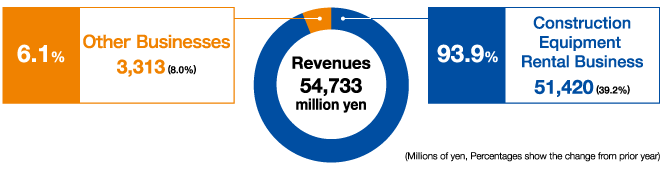

As a result of these efforts, consolidated revenues for the interim period of the Business Period ending October 2013 came to ¥54,733 million, up 36.8% compared with the same period of the previous consolidated fiscal year. With regard to earnings, operating income jumped 89.9% from the same period of the previous consolidated fiscal year to ¥6,751 million, ordinary income surged 103.6% year-on-year to ¥6,714 million and interim period net income rose 109.2% year-on-year to ¥3,716 million.

Segment Information

Divisional Sales and Sales Ratio (Consolidated)

Business related to the Construction Equipment Rental Division

Business related to the Construction Equipment Rental Division

main business of the Kanamoto Group, the Company sought to strengthen the response capabilities of the entire Group through measures such as an aggressive increase in assets, and appropriate asset allocation in various regions. Steps were taken to respond accurately to rental demand that will grow in the future, including restoration and recovery works and decontamination-

related works in earthquake stricken areas, coastline

shore protection works and soil improvement works, road-

related upkeep and maintenance works, disaster prevention and disaster mitigation works in areas throughout Japan, large-scale projects, especially in the heart of the Tokyo metropolitan area, and various worksite needs. Revenues by region in the construction equipment rental business expanded significantly in all regions compared with the same period of the previous fiscal year, growing 14.4% year-on-year in the Hokkaido Region and 39.7% in the Tohoku Region, climbing 76.3% in the Kanto Region, expanding 59.3% in the Kinki & Chubu Region and rising 14.1% in the Kyushu & Okinawa Region.

In the Kanto Region and Kinki & Chubu Region, which were substantially higher than the previous year, this mainly reflected the effect of Unite Co., Ltd., a company newly included within the scope of consolidation.

Overseas sales of used construction equipment were up 9.3% compared with the same period one year earlier, reflecting increased demand from other countries and the return of prices to more competitive levels because of the sudden weakening of the yen.

As a result of these factors, consolidated interim period revenues for Kanamoto's construction-related businesses increased 39.2% from the same period of the previous consolidated fiscal year to ¥51,420 million, and operating income climbed 92.2% year-on-year to ¥6,557 million.

Other Businesses

In the steel products sales the Company is developing in Hokkaido, revenues rose 9.3% compared with the same period of the previous year. This reflected factors such as comparatively steady sales for earthquake recovery sites and sales in the Central Hokkaido region, and higher prices in the steel materials market. In Kanamoto's information and telecommunications-related division, on the other hand, both personal computer rental demand and employee dispatch varied in line with the Company's business plan, edging up 0.8%.

As a result of these factors, for the consolidated interim period under review revenues from other businesses were ¥3,313 million, up 8.0% compared with the interim period of the previous consolidated fiscal year, and operating income was ¥63 million, off 0.8% year-on-year.

Business Development Issues Deserving Special Mention and Status of Branch Office Changes

To increase the operating efficiency of the Shutokenkousho Branch and the Shin-Kiba Branch, which were classified according to the types of products they handled at the same site, these two offices were integrated as the Tokyo Chuo Branch.

Consolidated Operating Results

| (Millions of yen; percentages show the change from prior year) | Fiscal Year Ended October 31, 2012: Second Quarter | Fiscal Year Ending October 31, 2013: Second Quarter | ||

|---|---|---|---|---|

| Revenues | 40,012 | 13.3% | 54,733 | 36.8% |

| Operating income | 3,554 | 106.1% | 6,751 | 89.9% |

| Ordinary income | 3,297 | 134.1% | 6,714 | 103.6% |

| Net income | 1,776 | – | 3,716 | 109.2% |

| Net income per share of common stock | ¥ 54.10 | – | ¥ 113.20 | – |

Divisional Sales (Consolidated)

| (Millions of yen; percentages show the change from prior year) | Fiscal Year Ended October 31, 2012: Second Quarter | Fiscal Year Ending October 31, 2013: | ||

|---|---|---|---|---|

| Construction Equipment Rental Business | 36,944 | 14.8% | 51,420 | 39.2% |

| Other Businesses | 3,068 | -2.3% | 3,313 | 8.0% |

| Total | 40,012 | 13.3% | 54,733 | 36.8% |

Projected Consolidated Operating Results for the Fiscal Year Ending October 2013

| (Millions of yen; percentages show the change from prior year) | Consolidated full-year projection | |

|---|---|---|

| Revenues | 103,410 | 20.1% |

| Operating income | 9,570 | 48.8% |

| Ordinary income | 9,230 | 55.6% |

| Net income | 4,530 | 26.7% |

| Net income per share of common stock | ¥ 137.98 | – |