Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_49annual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/49/annualreport/06/index4.html on line 92

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_49annual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/49/annualreport/06/index4.html on line 92

Feature| IT, Finance and Investment Strategies

Strategic business systems to promote profit margin improvement through "workforce optimization."

IT governance is essential for the practice of corporate strategy

In recent years there has been a growing need to provide for "IT governance." Described concisely, IT governance refers to appropriately establishing objectives and strategies when introducing and utilizing IT, measuring and assessing the results and risks, and establishing mechanisms that will make the "ideal application of IT" possible. For firms, the determination of whether IT is being utilized effectively to improve the efficiency of operations and achieve strategic objectives is enormously important. It's thought that in order to use IT more effectively, activities such as system operation and risk management should not be left to the system department, but should be addressed as company-wide issues.

Enhancement of information systems to boost operating efficiency

Kanamoto was an industry pioneer in creating an online network in 1985 linking all its branches. In 2004, we completed the migration of all mission-critical systems from a mainframe to an open system and realized greater efficiency in all of our internal operations, from managing our rental asset inventory to performing maintenance and regular inspections, accounting treatment and credit management, plus the selection of models for next-period introduction.

Kanamoto was an industry pioneer in creating an online network in 1985 linking all its branches. In 2004, we completed the migration of all mission-critical systems from a mainframe to an open system and realized greater efficiency in all of our internal operations, from managing our rental asset inventory to performing maintenance and regular inspections, accounting treatment and credit management, plus the selection of models for next-period introduction.

Providing "the right equipment" at "the right time" and in "the right quantity" can be said to be the foundation of equipment rentals, and Kanamoto's online system makes it possible. Not only does our online system ensure smooth equipment delivery and pickup, it contributes significantly to the formation of a product lineup and rental fleet that meets customers' needs.

Kanamoto will continue its efforts to develop "IT governance," and work to further increase the efficiency of internal operations while aggressively pursuing the development of proprietary systems in the future.

Improving profit margins through optimized asset management

Kanamoto has long considered its construction equipment management system and improvements in operating efficiency to be the wellspring of the Kanamoto Group's earnings. The Company also has launched a business reform project to thoroughly analyze and improve its current business processes. Through measures such as managing earnings through the disposal of under-utilized assets, and strengthening competitiveness by optimizing the mix of models and ages in the equipment portfolio, the Company is working to maximize earnings and improve operating profit margins during rental equipment operating periods.

A unique financial strategy corresponding to the characteristics of a stock business

Because equipment rental is a stock-based business, Kanamoto's ratio of interest-bearing debt is higher than in other industries. As a financial strategy to service this debt, Kanamoto is working to increase shareholders' equity, and reducing interest-bearing debt and streamlining its balance sheet to limit capital asset investment to within the scope of annual cash flow.

A future-oriented investment strategy to secure the source of Kanamoto's earnings

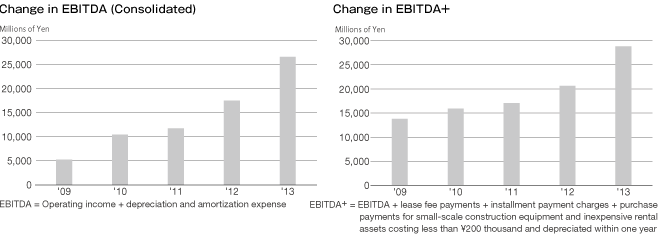

Kanamoto makes vigorous capital investments annually, which result in an amortization burden corresponding to this volume of assets. Equipment rental, however, is a business characterized by the ability to receive a gain from the sale of used equipment after rental earnings have been ensured. In other words, the depreciation expenses incurred during each fiscal year become the source of future earnings. For this reason, Kanamoto considers its most important management indicators to be EBITDA+ (operating income + depreciation and amortization expense + lease fee payments + installment payment charges + purchase payments for small-scale construction equipment and inexpensive rental assets) and ROI (return on investment), rather than current year operating results, and has always worked to achieve growth in these indicators.