Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_49annual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/49/annualreport/04/index.html on line 95

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_49annual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/49/annualreport/04/index.html on line 95

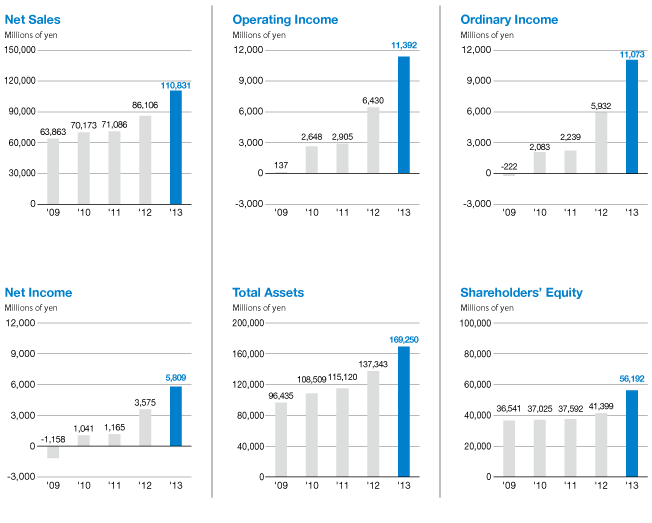

Consolidated Financial Highlights

| Millions of yen | Thousands of U.S. dollars (Note) |

||

|---|---|---|---|

| 2012 | 2013 | 2013 | |

Consolidated operating results |

|||

| Rental revenues and sales of goods | ¥86,106 | ¥110,831 | $1,125,082 |

| Operating income | 6,430 | 11,392 | 115,652 |

| Ordinary income | 5,932 | 11,073 | 112,410 |

| Net income | 3,575 | 5,809 | 58,971 |

| ROE | 9.3% | 12.3% | 12.3% |

| Dividend payout ratio | 18.4% | 11.4% | 11.4% |

| Plant and equipment investment | 21,814 | 28,348 | 287,773 |

Consolidated financial position |

|||

| Total assets | 137,343 | 169,250 | 1,718,108 |

| Shareholders' equity | 41,399 | 56,192 | 570,427 |

| Shareholders' equity ratio | 29.2% | 32.2% | 32.2% |

| Shareholders' equity per share (yen) | 1,221.56 | 1,513.49 | 15.36 |

Consolidated cash flows |

|||

| Cash flow from operating activities | 14,306 | 20,759 | 210,735 |

| Cash flow from investing activities | –835 | –1,117 | –11,343 |

| Cash flow from financing activities | –14,074 | –6,532 | –66,314 |

| Balance of cash and equivalents at end of period | 19,717 | 32,957 | 334,559 |

Information per share of |

Yen | U.S. dollars (Note) | |

|---|---|---|---|

| Net income | ¥ 108.88 | ¥ 175.50 | $ 1.78 |

| Dividends per share | 20.00 | 20.00 | 0.20 |

Financial Topics

Net Sales

During the current period, private sector capital investment demand remained brisk on a nationwide scale, particularly for energy-related construction. Government construction investment continued to expand as well, not only in the earthquake-devastated region but throughout Japan, including works to strengthen infrastructure and construction related to countermeasures, maintenance and repairs of deteriorating infrastructure. To respond accurately to such demands and diversified frontline needs, the Kanamoto Group moved to strengthen cooperation among Group firms, aggressively enhance its rental equipment portfolio and place these assets in optimal locations in the field. These actions generated significant net sales growth in every region.

Earnings

By seeking more efficient utilization of its management resources and striving to improve profit margins, while simultaneously moving to thoroughly analyze, enhance and improve the efficiency of its present activities and processes and initiating organizational changes aimed at strengthening earnings, the Group achieved results at the operating income, ordinary income and net income levels that substantially surpassed its performance in the prior period.