Warning: include(/home/c9205967/public_html/kanamoto.ne.jp/include/menu_48annual_en.php): Failed to open stream: No such file or directory in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/48/annualreport/14/index.html on line 80

Warning: include(): Failed opening '/home/c9205967/public_html/kanamoto.ne.jp/include/menu_48annual_en.php' for inclusion (include_path='.:/opt/alt/php82/usr/share/pear:/opt/alt/php82/usr/share/php:/usr/share/pear:/usr/share/php') in /home/c9205967/public_html/kanamoto.ne.jp/en/pub/48/annualreport/14/index.html on line 80

Report of Operating Results and Financial Position for the 48th Business Period

Report of Operating Results and Financial Position for the 48th Business Period

(November 1, 2011 – October 31, 2012)

Summary of Operating Results Operating Environment

During the consolidated fiscal year under review, Japan's economy was affected by forces that worked against one another. Early in the fiscal year, corporate operating performance exhibited a recovery trend supported by the restructuring of supply chains that had been disrupted by the Great East Japan Earthquake and by anticipation of restoration and reconstruction demand. The economy faced downward pressures, however, because of global economic uncertainties, ranging from Europe's prolonged debt crisis and financial difficulties in the United States to China's economic slowdown. These factors had a negative effect on corporate earnings as well. Personal consumption in general also remained sluggish, despite a flurry of existing home sales in certain metropolitan areas because of the anticipated hike in the consumption tax. Overall, the economic situation retained its subdued patina.

In the construction equipment rental business that is the main business of the Kanamoto Group, a mild recovery in private sector capital investment was evident as noted above. This investment lost momentum as the months passed, however. Although the volume of works continued its upward course because of restoration works in some of the devastated regions, even with government demand significant progress on restoration-related projects was not seen because of recovery policy delays. In regions that were not seriously affected by the earthquake and tsunami, on the other hand, some disaster prevention and disaster mitigation works were initiated, but the volume of this effort remained at a low level.

The Kanamoto Group responded to Japan's unprecedented calamity by positioning restoration and recovery from the Great East Japan Earthquake as the most important policy for every company in the group. At the same time, the Company strove to expand market share in unaffected regions, while working to improve profit margins through timely shifts of rental equipment and the efficient utilization of management resources. In light of the transportation conditions in the hardest-hit areas, Kanamoto established new branches and shifted its construction equipment emphasis to the equipment most in demand, and created an organization that is capable of responding without interruption to full-scale restoration works.

Revenues were up sharply in all regions because of several factors. The addition of Unite Co., Ltd. and its strengths in the road-related business in particular to the group during the fiscal year under review brought an expansion of operations, together with a concomitant significant improvement in Kanamoto's solutions function as a group. Furthermore, an encouraging trend was seen nationwide in rental unit prices that resulted from small but positive improvements in the balance of construction equipment demand-and-supply.

With regard to profits, the Company achieved earnings well above the level of the prior consolidated fiscal year. Several factors resulted in lower margins, including a higher burden of depreciation expense for construction equipment, and lower profits from equipment sales as a result of used construction equipment sales being postponed, because of the top priority placed on supporting earthquake restoration and recovery works. Nevertheless, rental revenues were strong in all regions, and asset utilization ratios improved because of the strengthening in some rental unit prices and steps taken to optimize asset utilization.

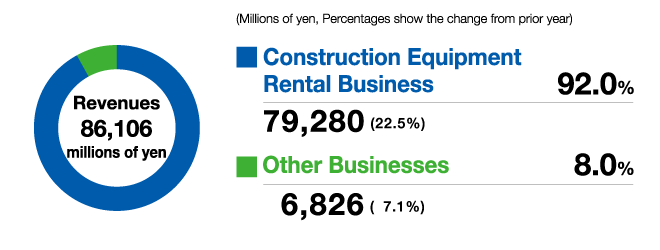

■ Percentage of net revenues by business (consolidated)

Summary of consolidated operating results by business segment

■ Business related to the Construction Equipment Rental Division

In the construction-related businesses of the entire Kanamoto Group, revenues and earnings were both higher. For the consolidated fiscal year under review, consolidated revenues increased 0.7% from the previous consolidated fiscal year to ¥64,711 million, and operating income rose 2.5% year-on-year to ¥2,586 million.

By region in Japan, the company was able to limit the year-on-year decline in rental revenue in the Hokkaido Region to 10.5%, despite lower demand from both the public and private sectors that signaled the diminished effect of economic stimulus measures in the previous fiscal year and a local economic slowdown. This result reflected the Company's overwhelming market share, plus demand from projects such as work for the Hokkaido Shinkansen. In other regions, demand in the Tohoku Region jumped 26.6% year-on-year because of special demand for restoration and reconstruction following the earthquake and heavy rainfall disasters. In the Kanto Region, demand grew 12.4% over the previous fiscal year because of demand for generators related to planned rolling blackouts and liquefaction damage restoration and reconstruction demand. Demand in the Kinki & Chubu Region, which was unaffected by the earthquake, was driven by heavy rainfall disaster restoration demand and private sector capital investment, rising 6.3% year-on-year. Finally, in the Kyushu & Okinawa Region, demand was nearly unchanged from the previous fiscal year, edging down just 0.1%, supported by past official demand, countermeasures following an eruption of Shinmoedake and storm disaster demand.

< Subsidiaries >

The Company's Construction Equipment Rental Division, Daiichi Machine Industries Co., Ltd. (a consolidated subsidiary company), Kanki Corporation (a consolidated subsidiary company), Toyo Industry Co., Ltd. (a consolidated subsidiary company) and Kyushu Kensan Co., Ltd. (a consolidated subsidiary company) are engaged in the rental and sale of foundation equipment, construction cranes, and construction equipment and tools. These companies borrow rental equipment assets from the Company as needed in order to meet customer demand. In addition, the Company borrows rental assets from each of these companies as needed to rent to other companies.

Assist Co., Ltd. (a consolidated subsidiary company) is engaged in the rental and sale of furniture, fixtures and safety products. Kanatech Co., Ltd. (a consolidated subsidiary company) designs and sells modular housing units for temporary use. The Company borrows rental assets from each of these companies as needed to rent to other companies. Kanamoto also purchases modular housing units for temporary use as needed to rent to its own customers.

Unite Co., Ltd. (a consolidated subsidiary), which Kanamoto acquired on June 28, 2012 through an acquisition of shares, is engaged in the rental and sale of road construction equipment, and also manages a road construction business. Unite Co., Ltd. borrows rental equipment assets from the Company as needed in order to meet customer demand. In addition, the Company borrows rental assets from Unite Co., Ltd. as needed to rent to other companies.

Shanghai Jinheyuan Engineering Construction Co., Ltd. (a consolidated subsidiary; Shanghai, China) and SJ Rental, Inc. (a consolidated subsidiary; Territory of Guam, United States), are engaged in the rental and sale of construction equipment and tools and the import and export of construction materials.

At its Board of Directors meeting held on September 7, 2012, the Company resolved to dissolve and liquidate SJ Rental, Inc., and plans to complete the liquidation in September 2013.

In addition to the above, Kanamoto has four unconsolidated subsidiaries: KG Machinery Co., Ltd., Flowtechno Corporation, KANAMOTO (HK) CO., LTD. (Hong Kong, China) and Kanamoto & JP Nelson Equipment (S) PTE. Ltd (Singapore). KG Machinery Co., Ltd. mainly rents specialized large-scale construction equipment in foreign countries. Flowtechno Corporation is engaged in the technical development, manufacture and sale of construction equipment for ground improvement works. KANAMOTO (HK) CO., LTD. borrows rental assets from Kanamoto and is engaged in the rental and sale of construction equipment and tools and the import and export of construction materials. Kanamoto & JP Nelson Equipment (S) PTE. Ltd rents and sells specialized equipment for engineering works in Singapore.

KG Machinery Co., Ltd. and Flowtechno Corporation merged on November 1, 2012, with KG Machinery Co., Ltd. as the surviving company, and as KG Flowtechno Co., Ltd. has strengthened Kanamoto's organization.

■ Other businesses

In the steel products sales the Company is developing in Hokkaido, sales of temporary housing materials and general steel materials remained steady, and revenues were up 7.6% compared with the prior consolidated fiscal year. In Kanamoto's information and telecommunications-related business, revenues edged up 3.8% year-on-year, boosted by orders for large projects, the renewal of personal computer rental periods and additional workstation rental demand that was developed through strenuous sales efforts, as well as steady demand in the Company's specified worker dispatching business.

As a result of the above factors, for the consolidated fiscal year under review revenues for the Company's other businesses increased 7.1% from the prior consolidated fiscal year to ¥6,826 million, while operating income was basically unchanged, up just 0.4% year-on-year to ¥143 million.

Fiscal Year ended October 31, 2012 Consolidated Operating Results

| (Millions of yen; % change from prior year) | Revenues | Operating Income | Ordinary Income | Net Income | Net Income per Share of Common Stock | ||||

| Consolidated Fiscal Year Under Review | 86,106 | (21.1) | 6,430 | (121.3) | 5,932 | (164.9) | 3,575 | (206.7) | ¥ 108.88 |

| Prior Consolidated Fiscal Year | 71,086 | (1.3) | 2,905 | (9.7) | 2,239 | (7.5) | 1,165 | (11.9) | ¥ 35.51 |

Earnings objectives of new long-term management plan (Consolidated)

| (Millions of yen) | Business Period ending October 2010 | Business Period ending October 2011 | Business Period ending October 2012 | Business Period ending October 2013 | Business Period ending October 2014 | |

| Consolidated revenues | Initial plan | 67,100 | 68,100 | 69,300 | 70,700 | 72,200 |

| Revised plan | * ¥70,173 | *¥71,086 | *¥86,106 | ¥99,150 | ¥101,300 | |

| Consolidated operating income | Initial plan | ¥1,100 | ¥1,800 | ¥2,900 | ¥3,800 | ¥4,300 |

| Revised plan | * ¥2,648 | *¥2,905 | *¥6,430 | ¥7,120 | ¥8,040 | |

An asterisk (*) indicates actual figures.

Change in number of branches

During the consolidated fiscal year under review, Kanamoto newly opened 8 branches and closed 5 branches.

New branches: Temporary Scaffolding Division, Temporary Scaffolding Sapporo Materials Center, Temporary Scaffolding Asahikawa Materials Center, Temporary Scaffolding Tomakomai Materials Center, Miyako Branch, Kamaishi Branch, Maebashi Branch, Hiroshima South Branch

Closed branches: Shimukappu Equipment Center, Isawa Equipment Center, Kamisato Branch, Iwaki Chuo Branch, Higashidori Branch

Medium to long-term corporate management strategy

The Kanamoto Group has formulated a Long-term Management Plan extending through the Business Period ending October 2014. However, because the management environment has changed more than initially assumed, the Company has re-set its earnings objectives for the two remaining fiscal years as follows.

Details of Kanamoto's management strategy are provided below.

a) Respond to the Great East Japan Earthquake and Fukushima nuclear accident

The Kanamoto Group has declared a full response in support of restoration and recovery work by every member of the Kanamoto Group as its most important activity. This effort includes ground improvement works, an activity in which Kanamoto particularly excels, establishing a full-time team to concentrate on the Fukushima nuclear accident, and support for decontamination operations. The Kanamoto Group will work zealously to achieve the quick restoration and recovery of the stricken areas.

b) Expand and enlarge Kanamoto's domestic base of operations

Beyond the Tokyo metropolitan area where much of Japan's public and private sector demand is concentrated, the Kanamoto Group is actively pursuing branch development, including M&A, in areas west of the Kanto Region where the Company's presence until now has been limited. Moreover, Group firms are also working to expand operations through cooperation centered on Kanamoto's Regional Special Procurement Sales Division.

c) Undertake overseas deployment

In addition to operations in mainland China, Hong Kong, Guam and Singapore where it has established overseas affiliates, the Company will pursue development in ASEAN countries that are exhibiting remarkable growth.

Because the sales of high-quality used construction equipment implemented by Kanamoto each year enhance the Company's reputation, and contribute substantially to business development in other countries, Kanamoto also will continue to offer high-quality used construction equipment for sale.

d) Take steps to improve operating activities

Kanamoto regards adept construction equipment management, together with improved operating efficiency, to be the foundation of the Group's earnings. Consequently we are taking steps to maximize earnings during the life of rental equipment and boost operating margins. These include launching operating improvement measures, thoroughly analyzing and enhancing current operational processes, strengthening loss controls and sharpening the Group's competitive capabilities.

Outlook for the next fiscal year (Business Period ending October 2013)

During Kanamoto's next consolidated fiscal year, the global economic slowdown is expected to continue, while in the financial market the strong yen and weak share price trends are not projected to change. These circumstances are forecast to have a significant adverse effect on corporate operating results. Personal consumption will also struggle to grow. When concerns such as possible electric power shortages, TPP issues and the timing of a consumption tax increase as well are taken into account, the economy is projected to remain in a situation in which the future outlook is clouded and there is little sign of any fundamental improvement in the business environment.

In the construction industry that is the main customer for the Kanamoto Group, spending other than earthquake-related investment is forecast to remain slack throughout Japan as a whole, despite some pockets of demand such as individual home purchases, which will be spurred by the anticipated consumption tax hike. Public works, on the other hand, will greatly boost construction equipment rental demand in the devastated regions as earthquake-related restoration works are undertaken on a full-scale. In regions other than those where earthquake recovery demand is anticipated, however, the construction equipment rental industry is likely to continue facing a tough management environment because of the intense competition among the main firms in each region.

The Kanamoto Group has declared its most important policy to be ongoing support for earthquake disaster recovery with the full capabilities of every group firm. Together with ensuring earnings and accomplishing its contribution to society in this area, the Company will continue efforts to form a solid base of operations focused on strengthening the Kanamoto Group's presence in metropolitan areas, and move forward with its plan to create a base for overseas activities.

The Company also plans to continue restricting to a certain quantity the sale of used construction equipment, which was partially postponed in order to utilize the equipment for earthquake disaster reconstruction, and will respond carefully to used equipment demand by monitoring overseas markets and the exchange rate trend.

To establish a business management organization capable of efficiently generating earnings, Kanamoto also will continue its focus on cost reductions and efficient asset deployment, and work to further strengthen its regional sales organization, which over the past several years has achieved significant results. At the same time, the Company will strive to further ensure earnings from other avenues, including the creation of rental demand in sectors other than construction-related market segments.

In the construction equipment rental business, rental demand is expected to remain driven by works related to full-scale restoration and recovery from the Great East Japan Earthquake and by disaster prevention and disaster mitigation countermeasures, particularly in the Tokyo metropolitan area. The full-year projection, which also reflects the contribution to operating results of Unite Co., Ltd., which became a Kanamoto subsidiary in June 2012, is shown in the table below. The Company will continue to watch regional construction demand trends closely, and work to establish a stable revenue base and strive to open and expand new domestic sectors and markets, while achieving synergistic effects through the efficient allocation of employees and assets, accurate response to customers' needs and cooperation with domestic affiliated firms.

Although overseas operations represent only a very small percentage of earnings at the present time, Kanamoto will continue efforts to expand this aspect of its business. This includes the overseas development of geoengineering-related firms, and expansion into new areas, primarily in Southeast Asian countries. The Company will seek to broaden its search for business opportunities in each region, with rentals as the main focus, while continuing to give full and proper consideration to country and business risks.

Fiscal year ending October 2013 Projected Operating Results

(November 1, 2012-October 31, 2013)

| (Millions of yen) | Revenues | Operating Income |

Ordinary Income |

Net Income |

Net Income per Share of Common Stock |

| Consolidated full-year projection | 99,150 | 7,120 | 6,510 | 3,190 | ¥97.16 |

| Non-consolidated full-year projection | 70,590 | 5,740 | 5,270 | 2,740 | ¥83.45 |